Use this calculator to figure out how much house/property you can afford and your monthly payment. Please let us know if you need any additional information: support [at] procalculator.com

What is a Mortgage?

A mortgage is a loan that you take out from your bank to buy, build or significantly improve your home. As a basic function of the loan, you have a designated time period to repay the loan (ex: 15, 30 years) and you personally guarantee that you will make all payments outlined in your mortgage’s payment schedule. Choosing the length of the mortgage often depends on the length of time that you plan on living in the residence.

Types of Mortgages

There are several types of mortgages and it is good practice to have a basic understanding of the different types before the application process.

- Fixed Rate Mortgage: These mortgages have a fixed or “locked in ” rate. You don’t have to worry that your payment will ever change over the lifetime of the mortgage loan. This can give many people peace of mind in knowing exactly what they will owe year after year, month after month. This is especially useful when you plan in staying a home a long time. Common lengths include 15, 20 or 30 years, although post 2008-2009 economic recovery, many financial institutions are offering customizable plans.

- Adjustable Rate Mortgage (ARM): This type of mortgage has an interest rate that can change based on a variety of factors. Factors such as economic conditions, markets, and the interest rate established by the FED. These is a greater level of risk associated with these mortgages when compared to fixed-rate mortgages, but can be advantageous in the right circumstances.

- Federal Housing Administration Loans (FHA) and Veterans Administration Loans (VA) : The government offers these as options for those eligible to lower the overall interest rates and allow more people to be able to purchase a home. The desired property to be purchased must pass a certain list of government requirements.

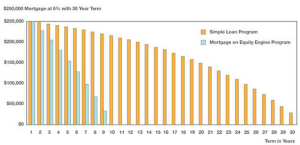

Example of a $250,000 home mortgage over 30 years

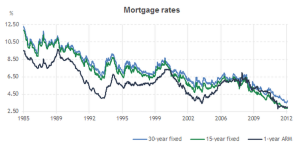

Historical Mortgage Rates

Leave a Reply