What is a 401k?

The 401k began in 1978. At its simplest, a 401k is a retirement plan. It is generally sponsored by an employer and allows their employees or participants to defer a portion of their wages (before taxes) to a retirement account. Employers can also offer other options to make contributions to the employee accounts including: profit-sharing and stock options. Being able to contribute money before taxes is a great way to build your nest egg and quickly generate security and wealth.

Contribution Limits:

For 2013, the contribution limit was set at $17,500 per year. Employees age 50 can also make an additional ‘catch-up’ payment of $5,500. The maximum employee and employer combination (i.e. profit sharing, contribution matching, etc) for a single year is at: $51,000 for 2013.

Types of Investments:

Most of the time, 401ks are invested into mutual funds, but can also contain specific stocks and bonds or other investment types.

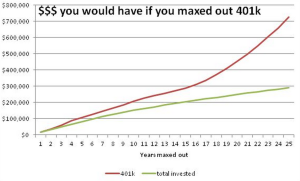

Example graph if you maxed out your 401k investment

Leave a Reply